key points:

- Bitcoin’s mining uses electricity to secure the network via Proof-of-Work; energy demand responds to price, competition, and hardware efficiency.

- The latest Cambridge study estimates ~138 TWh/year and ~0.5% of global electricity—with 52.4% sustainable energy (42.6% renewables + 9.8% nuclear) in miners’ reported mix. (Cambridge Judge Business School)

- Environmental impact is real (emissions, e-waste, noise), but the energy mix is shifting cleaner and miners increasingly tap stranded/curtailed energy (hydro, flared gas, wind/solar, demand response). (Cambridge Judge Business School, SEC, U.S. Energy Information Administration)

- Comparisons to countries/industries vary by method; reliable comparisons come from Cambridge CBECI and EIA/LBNL not single “per-transaction” metrics. (ccaf.io, U.S. Energy Information Administration, LBL ETA Publications)

- Future energy use hinges on ASIC efficiency, post-halving economics, policy, and Layer-2 adoption like Lightning (shifts payments off-chain). (shop.bitmain.com, Hashrate Index, Fidelity Digital Assets, ScienceDirect)

How Does Bitcoin Mining Actually Consume Energy? (A Simple Explanation)

What is Proof-of-Work (PoW)? The Engine of Bitcoin

Bitcoin’s ledger is secured by Proof-of-Work (PoW): miners bundle transactions into blocks and compete by hashing—performing vast numbers of SHA-256 guesses—until one finds a valid block header below the target. The “work” is verifiable by any node, making attacks prohibitively expensive. This design was laid out in the Bitcoin whitepaper and remains fundamental to Bitcoin’s security model. (bitcoin.org)

From a systems view, energy is the cost that enforces honesty: to rewrite history, an attacker must out-compute the honest network, paying real electricity. The official Bitcoin FAQ emphasizes that spending energy to secure a payment network isn’t “waste” per se; it’s the cost of decentralization and immutability. (bitcoin.org)

Why Competition Between Miners Leads to High Energy Use

Mining is a race: higher hashrate → higher odds to win the block reward + fees. When price rises, more hashing becomes profitable, drawing in more machines and energy. The Cambridge methodology explicitly models miners as rational, profit-seeking agents and builds hardware baskets to estimate network power draw. (ccaf.io)

Hardware efficiency (measured in Joules per terahash, J/TH) is improving—e.g., Bitmain’s S21 XP Hydro reaches ~12 J/TH under advertised specs—yet total energy can still rise because more machines get deployed when economics allow. (shop.bitmain.com, Asic Marketplace)

The Numbers: How Much Energy Does Bitcoin Really Use?

Cambridge Bitcoin Electricity Consumption Index (CBECI)

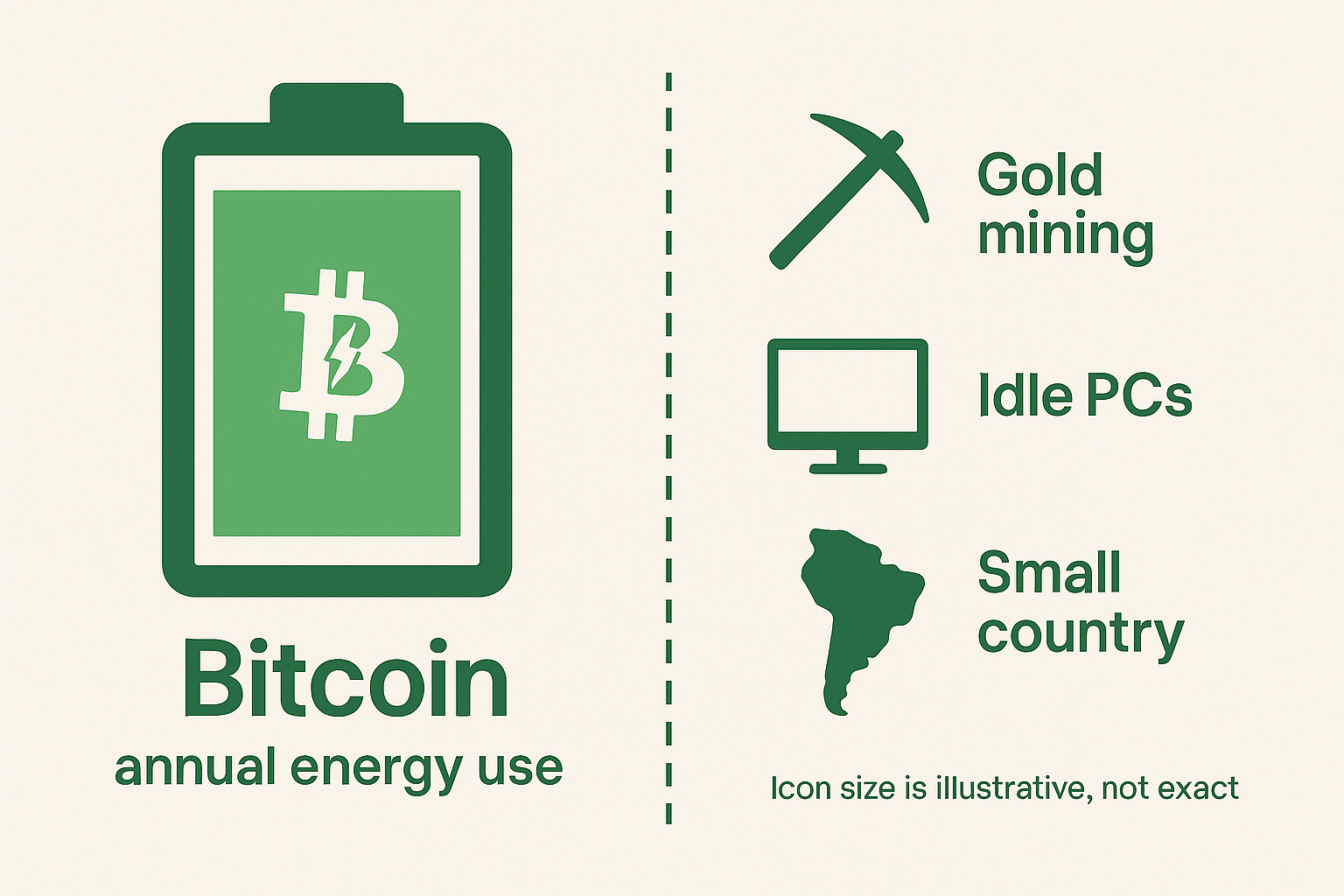

The Cambridge Digital Mining Industry Report (April 28, 2025)—based on survey data covering 48% of global mining—estimates ~138 TWh/year, ~0.5% of global electricity, and ~39.8 MtCO₂e emissions. It also finds 52.4% of miners’ energy is sustainable (42.6% renewables, 9.8% nuclear), with natural gas 38.2% and coal 8.9%—a notable shift away from coal since 2022. (Cambridge Judge Business School)

CBECI’s comparisons page helps put those numbers in context and warns against misleading apples-to-oranges comparisons (e.g., “per-transaction” energy). Use annualized consumption and transparent methods. (ccaf.io)

Other trackers exist. Digiconomist often reports higher figures (e.g., ~188 TWh annualized alongside larger CO₂ estimates), partly due to different assumptions. Treat non-Cambridge estimates carefully and compare methodologies. (Digiconomist)

Perspective: Comparing Bitcoin to Countries & Other Industries

- Countries: CBECI’s comparison tool ranks Bitcoin against nations’ electricity use to provide scale; values move with price, hashrate, and efficiency. (ccaf.io)

- United States (subset view): The U.S. EIA’s preliminary estimate suggests crypto mining used ~0.6%–2.3% of U.S. electricity (wide range due to data gaps), underscoring why top-down + bottom-up estimates must be reconciled. (U.S. Energy Information Administration)

- Data centers: For context, the LBNL U.S. Data Center Energy Usage Report (2024) quantifies sectoral draw, which is increasingly relevant as miners colocate with or pivot to AI compute. (LBL ETA Publications)

A Critical Comparison: Bitcoin vs. the Traditional Banking System

Apples-to-apples comparisons are hard. Banks span ATMs, branches, armored transport, card networks, data centers, etc., with no unified energy ledger. Earlier industry analyses (e.g., Galaxy Digital 2021) argue banking uses more, but data transparency is limited and methodologies vary. Reliable institutions like Cambridge stress methodological care when comparing across sectors. Use such comparisons cautiously and state assumptions. (ccaf.io)

The Great Debate: Is Bitcoin’s Energy Consumption a “Waste”?

The Argument Against: Environmental Impact & Carbon Footprint

Critics point to emissions, noise, water/thermal impacts, and e-waste. Peer-reviewed work estimates 30–60 kt/year of e-waste under certain market conditions, largely due to short ASIC lifecycles; Cambridge has acknowledged e-waste as a material negative externality needing better data. Communities near large sites also complain about noise (100 dB class) and quality-of-life impacts. (ADS, Cambridge Judge Business School, TIME)

Governments have responded: the U.S. EIA attempted targeted energy surveys; Texas and other jurisdictions have debated or implemented rules to manage grid integration, disclosure, and emergency curtailments. Norway has proposed a temporary ban on new PoW mining data centers from autumn 2025 to prioritize electricity for other uses. (U.S. Energy Information Administration, Chron, Reuters)

The Argument For: Securing a Global Monetary Network

Supporters argue energy consumption is the price of uncensorable, neutral money; energy anchors security, and miners often act as flexible loads, absorbing surplus energy and powering down in grid stress—valuable as wind/solar penetration grows. Texas ERCOT’s experience with demand response and miners’ participation (e.g., Riot’s 2023 credits) illustrates this flexibility. (Yes Energy Blog, SEC)

Some operators reduce emissions by monetizing flared/vented gas that would otherwise escape or be burned, turning waste into electricity. Multiple pilots and reports—from Reuters on oilfield mining to majors exploring flare-gas BTC pilots—document this trend. (Reuters, Bloomberg.com)

The Renewable Energy Revolution in Bitcoin Mining

How Bitcoin Mining Incentivizes Cheap, Stranded Energy

Miners chase the lowest-cost electrons: curtailed hydro in rainy seasons, negative-priced wind in congested zones, remote geothermal, or associated gas where pipelines don’t reach. In grids like ERCOT, frequent price volatility and congestion create periods where power is dirt cheap or even negative—ideal for interruptible loads like mining. (Lod.io)

Case Studies: Flared Gas, Hydro, Solar/Wind

- Flared Gas: Oilfield-sited miners consume associated gas that would be flared, potentially reducing methane’s climate impact if managed properly. Coverage includes Reuters and industry pilots. (Reuters)

- Hydropower Regions: Paraguay (Itaipú) has attracted miners to absorb surplus hydro; Marathon, Sazmining and others cite renewable, low-cost energy as the draw. Bhutan mines with sovereign hydropower as part of a national strategy. (MARA, Decrypt, Reuters)

- Iceland/Quebec/Norway: Longstanding hubs leveraging hydro/geothermal, though Nordic surplus outside Iceland is tightening. Policy in Norway is turning more restrictive on new PoW data centers to preserve power for industry. (Data Center Knowledge, Reuters)

- MENA: Oman has launched large-scale, immersion-cooled facilities with regional partners; the UAE hosts sizable miners and specialized free-zones. (Forbes, CoinDesk)

Statistics & Trends: What Percentage of Mining Is “Green”?

The Cambridge 2025 report puts sustainable energy at 52.4% (42.6% renewables + 9.8% nuclear) in its respondent-weighted dataset; gas 38.2%; coal 8.9%. Industry groups like the Bitcoin Mining Council often report >60% sustainable shares, but figures depend on definitions, samples, and self-reporting. Treat Cambridge as the academic baseline and industry surveys as complementary. (Cambridge Judge Business School, Kenson Investments)

The Future of Bitcoin’s Energy Use: What to Expect

The Halving’s Impact on Mining Profitability & Energy

The April 2024 halving cut the block subsidy to 3.125 BTC, squeezing margins. Historically, halving filters out inefficient miners, accelerates hardware refresh, and can nudge the energy mix cleaner (survivors seek the cheapest/cleanest baseload and DR revenue). Institutional analyses explain how halving reshapes the “security budget” and miner behavior. (Blockpit, Fidelity Digital Assets)

Layer-2 Solutions (Lightning Network) & Energy

Lightning shifts many small payments off-chain, reducing on-chain congestion. Academic work finds LN adoption is associated with improved payment throughput and efficiency—even though total mining energy largely follows price and competition, per-payment energy intensity can fall as more commerce happens off-chain. (ScienceDirect, alaworkshop2023.github.io)

Innovation in Mining Hardware (More Efficient ASICs)

The J/TH frontier keeps moving: top-bin hydro or immersion rigs in the ~12–15 J/TH class are now common at scale, with more efficient thermal envelopes. Even so, if price rallies, network hashrate can outpace efficiency gains—so energy use is a moving target tied to economics. (shop.bitmain.com, Hashrate Index)

Frequently Asked Questions (FAQs)

Is Bitcoin going to switch to Proof-of-Stake like Ethereum?

There’s no credible roadmap to move Bitcoin off PoW. Bitcoin’s security and governance are anchored in PoW; the whitepaper and community norms emphasize energy-backed finality. Alternative designs exist, but Bitcoin core stakeholders have not signaled a PoS migration. (bitcoin.org)

Does holding or using Bitcoin consume a lot of energy?

Holding BTC does not meaningfully increase energy use; mining is the main driver. Running a wallet or even a full node consumes modest device power. Network energy isn’t a fixed “per-transaction” meter—hashrate tracks miner economics, while Lightning can move many payments off-chain. (bitcoin.org, ScienceDirect)

How can I support greener Bitcoin mining?

- Prefer services or mining partners that audit their energy mix (renewables/nuclear) and publish data.

- Support demand-response friendly miners that curtail in grid stress (pro-grid). (Yes Energy Blog)

- Back public policies promoting renewables build-out, grid transparency, and methane abatement via on-site generation (with rigorous measurement). (Reuters)

- When spending, consider Lightning where appropriate to reduce on-chain congestion. (ScienceDirect)

Regional Snapshot: What This Means Where You Live

North America:

- U.S. (Texas/ERCOT): Explosive load growth from data centers + miners; ERCOT and state lawmakers tighten registration, DR participation, and emergency curtailment powers. If you mine in Texas, expect interconnection scrutiny, DR program opportunities, and community noise rules. (U.S. Energy Information Administration, potomaceconomics.com, Chron)

- Canada (Québec): Hydro-rich but capacity-constrained; allocations for large loads are competitive—miners that can flex load and site near surplus hydro fare better. (See hydropower case discussions.) (adesso.de)

Europe:

- Norway/Iceland: World-class clean power, but Norway plans a temporary ban on new PoW mining data centers from autumn 2025, while Iceland remains a geothermal/hydro hub with tight capacity. (Reuters, Data Center Knowledge)

- Policy note: EU members scrutinize power-intensive data centers; access can hinge on demonstrating grid benefits and local value.

Asia:

- Bhutan: State-backed, hydropower Bitcoin mining framed as “green compute” and economic development; expansion depends on significant hydro build-out. (Reuters)

- Pakistan: Announced 2,000 MW for Bitcoin mining and AI data centers to utilize surplus capacity—watch implementation details and tariff structures. (Reuters)

Africa:

- Hydro/solar potential is large but grid constraints and policy are key. Look for behind-the-meter pilots where stranded renewables or curtailed hydro exist.

Latin America:

- Paraguay: Itaipú surplus has drawn miners; policy swings between courting miners and cracking down on illegal connections. If operating there, ensure utility-approved hookups and compliance. (MARA, Cointelegraph)

- Argentina: Regions like Tierra del Fuego have clamped subsidies and scrutinized miners’ grid impacts. (Argentina Reports)

Australia & Oceania:

- Strong wind/solar build-out and curtailment windows create price-negative events in certain regions, but interconnection and community engagement are decisive.

Middle East (MENA):

- Oman: Large, immersion-cooled projects; government-aligned investments signal long-term plans.

- UAE: Active mining footprint and specialized free-zones; policy is innovation-friendly but expects robust compliance and noise/heat management. (Forbes, CoinDesk)

Practical How-To: Supporting Green Bitcoin Mining (Step-by-Step)

- Choose “green-proven” providers: If you host or buy hashrate, demand third-party energy audits, location details (interconnection, resource type), and curtailment policies.

- Ask for grid services participation: DR enrollment, response times, and historical curtailment data show whether a miner is a good grid citizen. Texas examples reveal significant DR credits when miners power down. (SEC)

- Methane mitigation: For oilfield-adjacent mining, review vendors’ methane measurement and combustion completeness and how they report avoided emissions (beware creative accounting). (Reuters)

- Prefer clean baseload regions: Hydro/geothermal (e.g., Bhutan, Iceland, Quebec) or nuclear-adjacent siting reduces net emissions if verified. (Reuters, Data Center Knowledge)

- Transact via Lightning when feasible: For everyday payments, LN can reduce on-chain load and fees. (ScienceDirect)

- Community engagement: If deploying facilities, budget for noise abatement (immersion cooling, acoustic barriers) and transparent reporting to local councils. (TIME)

What’s Next? Evidence-Based Predictions

- Efficiency keeps improving (single-digit J/TH class on niche or hydro-cooled rigs), but macro economics (price, fees, AI competition for power) dominate total energy. Expect hasher-AI convergence (shared campuses, flexible power contracts). (shop.bitmain.com, Financial Times, TIME)

- Cleaner mix continues as coal’s share falls and gas + renewables + nuclear expand; flare-gas monetization grows where regulation permits, but requires transparent emissions accounting. (Cambridge Judge Business School)

- Policy bifurcation: Hydro-rich jurisdictions with clear rules (Bhutan, select LatAm) attract “green compute,” while places facing tight capacity (Norway) restrict new PoW. This policy arbitrage will shape the geography of hashpower in 2025-2027. (Reuters)

- Scaling via Layer-2: More commerce will route via Lightning and other L2s, shrinking the per-payment energy footprint, even if aggregate mining energy follows market cycles. (ScienceDirect)

Conclusion: A Nuanced and Evolving Issue

Bitcoin’s energy story isn’t static. The best current data suggest a network that consumes ~138 TWh/year, increasingly leans on sustainable energy (52.4%), and shows rapidly improving hardware efficiency, while still presenting real externalities (emissions, noise, e-waste) that must be managed. The right question isn’t “Does Bitcoin use energy?”—it’s how that energy is sourced, how flexibly miners integrate with grids, and how policy and markets steer the mix. With transparent measurement, smarter siting, and grid-helpful operations, Bitcoin can coexist with—and even catalyze—cleaner power systems as they scale. (Cambridge Judge Business School, LBL ETA Publications, U.S. Energy Information Administration)

Disclaimer

This guide is educational and not financial, investment, or legal advice. Crypto assets are volatile and high-risk. Energy, environmental, and regulatory conditions change quickly—always verify current rules and consult qualified professionals before making decisions or investments.