Here 21 key points:

Fractional Bitcoin Basics:

(1) You can buy small Bitcoin amounts; (2) Bitcoin splits into 100M satoshis; (3) Satoshis enable small investments; (4) Ownership is blockchain-verified.

Buying Process Simplified:

(5) Choose beginner-friendly exchanges; (6) Complete KYC verification; (7) Deposit funds (bank/card); (8) Purchase Bitcoin fractions easily.

Fees & Minimum Amounts:

(9) Minimum buys as low as $1–2; (10) Fees higher on small amounts; (11) Larger purchases lower relative fees.

Investment Approach (DCA):

(12) Small, regular investments recommended; (13) Reduces impact of volatility; (14) Encourages disciplined saving.

Fractional Ownership Validity:

(15) Fractional Bitcoin fully legitimate; (16) Secure and transparent on blockchain.

Bitcoin vs. Altcoins:

(17) Bitcoin offers stability and dominance; (18) Altcoins carry higher risks, potential rewards; (19) Evaluate crypto by market cap, not price.

Security & Taxation:

(20) Use secure wallets for larger amounts; (21) Profits from sales taxable events.

The Simple Answer: Yes, You Can (And Should) Buy a Fraction of a Bitcoin

If you’ve ever thought about investing in Bitcoin but felt discouraged by its high price—often tens of thousands of dollars—you might have asked yourself: “Can I buy a fraction of a Bitcoin instead?”

The straightforward, reassuring answer is yes.

You absolutely can purchase a small fraction of a Bitcoin, and doing so is not only possible but highly recommended, especially for new investors.

Bitcoin was designed to be highly divisible precisely to allow people with various financial means to participate in this digital economy 1.

Unlike traditional investments like real estate or certain stocks, Bitcoin doesn’t require you to buy a “whole” asset. Whether you have $50, $20, or even just $1, Bitcoin can accommodate your budget.

This approach makes Bitcoin far more accessible and inclusive. You don’t need to be wealthy or a financial expert to get started. In fact, one of Bitcoin’s fundamental principles is financial inclusion—allowing everyone, regardless of their wealth, to invest and participate 2.

Why This is Possible: Introducing the “Satoshi,” Bitcoin’s Smallest Unit

Bitcoin can be divided into 100 million smaller units called satoshis (or “sats”). Think of a satoshi as similar to a cent in a dollar; just as a dollar is divided into 100 cents, a single Bitcoin is divided into 100 million sats.

Named after Bitcoin’s mysterious creator, Satoshi Nakamoto, this tiny unit enables people to invest very small amounts comfortably 3.

Because of this divisibility, you can easily buy, sell, trade, and own fractional Bitcoin.

Even with just a small fraction, like 0.0001 BTC (10,000 sats), you’re officially a Bitcoin holder with real ownership verified by the Bitcoin blockchain.

Every satoshi you buy is securely stored and fully verifiable, giving you complete confidence that even your smallest investment is legitimate and meaningful.

How Much Can You Start With? (Hint: As Little as $1)

One common misconception among new investors is that Bitcoin is prohibitively expensive to buy.

While a full Bitcoin may cost tens of thousands of dollars, fractional Bitcoin investments can start from very small amounts—as little as $1 on many cryptocurrency exchanges.

Platforms like Coinbase, Kraken, and Binance, among others, allow purchases of tiny fractions of Bitcoin with minimal initial deposits 4.

For example, if Bitcoin is trading at $50,000 per coin, buying $5 worth would give you 0.0001 BTC, or 10,000 satoshis.

This flexibility allows virtually anyone to become a Bitcoin investor, regardless of their budget size.

Thus, you don’t need to wait or feel excluded because of Bitcoin’s seemingly high price.

Even a tiny investment can represent your first important step into the world of digital currencies and long-term financial planning.

Overcoming the Psychological Barrier of a High Price

Perhaps the greatest barrier for new investors isn’t the practical aspect of buying fractional Bitcoin—it’s the psychological hurdle.

Bitcoin’s high price can feel intimidating and make it seem like you’ve missed your opportunity. You might think, “It’s too late for me,” or “I’m not wealthy enough to participate.”

But here’s the truth: Bitcoin is not reserved for wealthy investors.

The ability to buy fractions was intentionally designed to welcome everyone, no matter their financial situation.

Buying fractional Bitcoin is a common and sensible strategy used even by experienced investors who regularly purchase small amounts over time to build a significant holding.

This approach—known as dollar-cost averaging (DCA)—lets you invest consistently, smoothing out volatility and reducing the stress of timing the market perfectly.

When you adopt this mindset, Bitcoin’s high price is no longer intimidating but rather an indicator of its value and potential.

You begin to realize that your small fractional investment is valuable precisely because Bitcoin has already demonstrated significant long-term growth potential.

In other words, fractional investing is your way of ensuring you never feel left behind.

You’re not late to the party; in fact, fractional ownership means the party has just started for you.

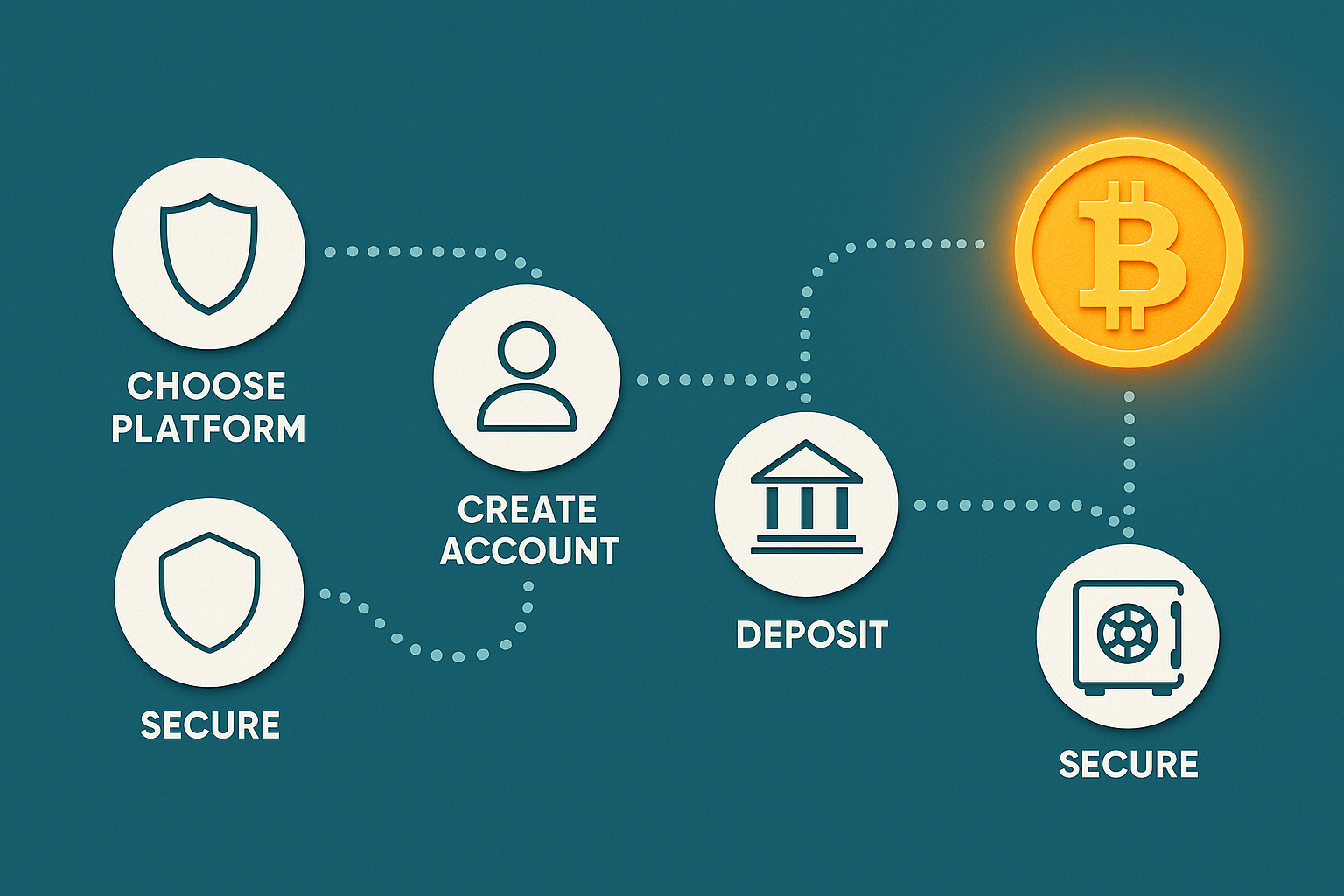

Step-by-Step Guide: How to Buy Your First Fraction of Bitcoin Today

Now that you understand clearly that buying fractional Bitcoin is possible, practical, and smart, you’re probably wondering how exactly you can do this safely and effectively.

Fortunately, the process is straightforward, even for complete beginners. Below is a clear, step-by-step guide to help you purchase your first fraction of Bitcoin.

Step 1: Choose a Reputable and Beginner-Friendly Cryptocurrency Exchange

Your journey begins with selecting the right cryptocurrency exchange. Exchanges are online platforms where you can easily buy, sell, and hold Bitcoin.

Popular exchanges like Coinbase, Kraken, Binance, and Gemini are reputable, regulated, and beginner-friendly. These platforms provide user-friendly interfaces, helpful guides, customer support, and robust security measures, making them ideal starting points for beginners 5.

When selecting an exchange, consider the following factors:

- Ease of Use: Choose an exchange with a straightforward interface designed for beginners.

- Security: Ensure the exchange has strong security features, such as two-factor authentication (2FA) and insurance coverage.

- Reputation: Select platforms widely trusted by the cryptocurrency community.

- Fees: Look for exchanges with transparent and reasonable fees.

Step 2: Create and Secure Your Account (KYC Explained)

After choosing an exchange, you’ll need to create an account. This process typically involves providing basic personal information and undergoing a verification process known as Know Your Customer (KYC).

KYC is a regulatory requirement to prevent fraud, money laundering, and other illegal activities. You’ll usually need:

- Proof of Identity: A valid ID (passport, driver’s license, national ID).

- Proof of Address: Utility bill, bank statement, or official document showing your address.

Once submitted, the verification process usually takes anywhere from a few minutes to a few days, depending on the exchange.

For security, activate two-factor authentication (2FA), which adds an additional layer of protection to your account. Using authenticator apps like Google Authenticator is strongly recommended over SMS-based authentication for added security 6.

Step 3: Deposit Funds (USD, EUR, etc.) into Your Account

With your account verified and secured, you’re ready to deposit funds.

Most exchanges allow various payment methods such as bank transfers (ACH in the U.S. or SEPA in Europe), debit or credit cards, PayPal, or wire transfers.

To deposit funds, simply navigate to your exchange’s “Deposit” or “Funds” page, select your preferred payment method, and follow the clear instructions provided.

Deposits via bank transfer are typically the cheapest option but can take 1-3 days. Debit and credit card transactions are instant but usually come with higher fees 7.

Step 4: Placing Your First Bitcoin Purchase Order (For Any Amount)

Once your funds are deposited, you’re now ready to buy your first fraction of Bitcoin.

To purchase, navigate to the “Buy” section of the exchange and enter the amount you wish to invest. You can enter either the dollar amount (e.g., $50) or the specific fraction of Bitcoin you wish to purchase (e.g., 0.001 BTC).

After entering the amount, review the details carefully—including the current Bitcoin price, fees, and the total amount you’ll receive. Once confirmed, submit the order. Your fractional Bitcoin purchase should process instantly.

Congratulations—you’re officially a Bitcoin owner!

Step 5: Where is Your Fractional Bitcoin Stored? (Understanding Exchange Wallets)

When you buy Bitcoin on an exchange, the fractional Bitcoin you’ve purchased is initially stored in an exchange wallet provided by the platform. An exchange wallet is a custodial wallet, meaning the exchange holds the private keys required to manage your Bitcoin.

While custodial wallets are convenient for beginners, they do involve a level of trust in the exchange’s security.

If you plan on holding larger amounts of Bitcoin for the long term, you should consider transferring your Bitcoin to a private, non-custodial wallet (also known as a “cold wallet” or hardware wallet). Private wallets, such as Ledger or Trezor, provide higher security by giving you sole control over your private keys.

However, for small amounts and beginner users, using your exchange wallet is generally safe and practical.

Key Tips for Safe First-Time Buying:

- Start Small: Invest an amount you’re comfortable with to familiarize yourself with the process.

- Verify Every Step: Always double-check transaction details before finalizing any order.

- Prioritize Security: Enable two-factor authentication and consider private wallets for larger holdings.

Taking these steps helps ensure your entry into fractional Bitcoin investing is smooth, secure, and straightforward 8.

Understanding Fractional Ownership: Key Concepts for New Investors

By now, you’ve learned that purchasing fractional Bitcoin is not only feasible but also remarkably simple and secure. However, you may still have some lingering questions:

- What exactly is a fractional Bitcoin?

- How does owning a fraction actually work?

- Is your fractional Bitcoin just as valid as owning a whole coin?

This section answers those questions clearly, giving you the confidence to understand fractional Bitcoin ownership fully.

What is a Satoshi? A Deep Dive into the 100 Million Pieces of a Bitcoin

When you buy a fraction of Bitcoin, you’re buying what’s known as “satoshis” or “sats,” the smallest unit of Bitcoin. One Bitcoin equals exactly 100,000,000 satoshis.

To illustrate, imagine Bitcoin as a digital pizza cut into 100 million identical slices. Each slice (a satoshi) represents a tiny portion of the entire Bitcoin. Even if you buy a single slice—or 100 sats, or 10,000 sats—you genuinely own a real piece of that Bitcoin pizza.

Why does Bitcoin have such extreme divisibility?

Bitcoin was intentionally designed this way to facilitate microtransactions and broader financial inclusivity. It allows people globally, regardless of their wealth, to participate in the digital currency economy. Whether you’re buying something small or investing regularly in tiny increments, sats enable practical usage and investment 9.

Do You Truly Own Your Bitcoin If It’s Only a Fraction? (Explaining Blockchain Ownership)

A common misconception among beginners is the belief that owning only a fraction means they don’t truly own Bitcoin. Rest assured, even if you own just a tiny fraction, you fully and genuinely own Bitcoin.

This is because Bitcoin ownership is recorded publicly and permanently on the blockchain—a digital ledger accessible and verifiable by anyone worldwide. Each satoshi you buy is precisely accounted for on the blockchain. Your fraction of Bitcoin isn’t just a notation in an app; it represents genuine, secure ownership.

To illustrate further:

Imagine your fractional Bitcoin ownership like owning shares in a publicly traded company. Even if you only own a single share, you still have legal ownership of part of that company. Similarly, owning just a few satoshis gives you full and legitimate ownership of that small fraction of Bitcoin.

Your ownership is also secured cryptographically, meaning it cannot be altered or falsified, ensuring your fractional Bitcoin remains yours indefinitely 10.

The Power of Small, Consistent Investments: An Introduction to Dollar-Cost Averaging (DCA)

Now that you understand fractional ownership, let’s discuss a powerful and practical investment approach: Dollar-Cost Averaging (DCA).

DCA means investing fixed amounts of money into Bitcoin at regular intervals—such as weekly or monthly—regardless of its price. Over time, this strategy reduces the impact of market volatility, making investing less stressful and more disciplined.

How exactly does DCA help small investors?

- Reduces emotional investing: It removes the pressure of buying at the “perfect time,” making investment decisions easier.

- Averages out volatility: Because you invest regularly, you buy more Bitcoin when prices are low and less when prices are high, lowering your average purchase price over time.

- Encourages disciplined investing: Regular investments, even if small, add up over time, gradually building a significant position in Bitcoin without large upfront costs 11.

This approach is particularly beneficial for new investors who feel uncertain about when or how much to invest. By consistently buying small fractions of Bitcoin, your investment can steadily grow, helping you build confidence and financial security.

Tracking the Value of Your Fractional Bitcoin

Owning fractional Bitcoin also means you’ll want to keep track of your investment value over time. Fortunately, monitoring your fractional Bitcoin holdings is straightforward.

Most cryptocurrency exchanges and wallet apps clearly display your fractional Bitcoin balance, showing both the number of satoshis you own and their current equivalent value in your local currency.

There are also numerous portfolio tracking apps, such as Blockfolio or Delta, that offer real-time price updates, market news, and comprehensive portfolio tracking tools. Using these apps allows you to easily monitor your fractional Bitcoin investment, understand its current market value, and observe how it changes over time 12.

By regularly checking and understanding your investment, you stay informed and in control, helping you make smarter financial decisions in the long run.

Fractional Bitcoin Ownership is Real Ownership

To sum it up simply and clearly: fractional Bitcoin ownership is genuine, secure, and strategically advantageous, especially for new investors.

Remember these essential points:

- Satoshis (sats) are the smallest Bitcoin units, enabling fractional ownership.

- Fractional ownership is fully recognized and secured by the Bitcoin blockchain.

- Dollar-Cost Averaging (DCA) is a powerful investment strategy ideal for beginners.

- Monitoring fractional Bitcoin ownership is easy and straightforward with modern tools.

Armed with this understanding, you now possess the knowledge and confidence needed to begin and grow your fractional Bitcoin investment journey effectively.

Comparing Your Options: 0.01 BTC vs. Owning Whole “Altcoins”

As a new investor exploring cryptocurrency, you might face a common dilemma:

Should you invest in a tiny fraction of Bitcoin (like 0.01 BTC) or buy entire coins of cheaper alternative cryptocurrencies (often called “altcoins”)?

It’s natural to find altcoins appealing because of their lower prices. After all, owning thousands of units of a cheap coin might feel better than owning just a fraction of a single Bitcoin.

However, there’s more to smart crypto investing than simply the number of coins you hold.

In this section, you’ll clearly understand the benefits and risks of each approach, enabling you to make an informed decision based on your financial goals.

The Argument for Owning a Small Piece of a Dominant Asset (Bitcoin)

Bitcoin remains the most dominant and widely recognized cryptocurrency globally. Its market leadership, widespread adoption, and growing institutional acceptance make it uniquely valuable among cryptocurrencies.

When you buy a fraction of Bitcoin—even a very small one—you own part of a proven, dominant asset. Bitcoin enjoys significant advantages, including:

-

Network Effects: Bitcoin benefits from a massive global network of users, investors, and developers. This expansive network strengthens its security, reliability, and resilience against market volatility13.

-

Institutional Investment: Major institutions—such as PayPal, Tesla, and BlackRock—have invested in or adopted Bitcoin, signaling its legitimacy and long-term value14.

-

Market Leadership: Bitcoin holds roughly 50% or more of the total cryptocurrency market capitalization, signifying its enduring strength and market dominance.

Even a small fractional ownership of Bitcoin positions you to benefit from these significant advantages, offering stability, credibility, and long-term potential.

The Risks and Rewards of Buying Cheaper, Whole Alternative Coins (Altcoins)

Altcoins like Ethereum (ETH), Cardano (ADA), or Solana (SOL) can indeed appear tempting because their unit price is significantly lower than Bitcoin.

With the same money spent on 0.01 BTC, you might be able to purchase a whole altcoin (or even several).

However, investing in altcoins comes with its own unique set of risks and potential rewards:

Rewards:

-

Higher Growth Potential: Altcoins sometimes experience explosive growth due to innovation or increased adoption, potentially offering large returns in a shorter time frame.

-

Technological Innovation: Many altcoins introduce new blockchain technologies, platforms, or functionalities that Bitcoin doesn’t offer, potentially opening opportunities for specialized investments.

Risks:

-

Higher Volatility: Altcoins can experience extreme price fluctuations, making them riskier and less predictable investments compared to Bitcoin.

-

Lack of Proven Longevity: Many altcoins fail to sustain long-term value, sometimes collapsing dramatically. Their smaller market sizes mean higher risk and uncertainty15.

-

Regulatory Risks: Altcoins often face greater regulatory uncertainty, adding to investment risk.

Thus, investing in altcoins requires thorough research, careful risk management, and willingness to tolerate significant market fluctuations.

Why Market Capitalization Matters More Than a Single Coin’s Price

A common beginner mistake is to equate a cryptocurrency’s lower price per coin with greater affordability or better value.

However, what’s most crucial for evaluating a cryptocurrency is its market capitalization (market cap), calculated as:

Market Cap = Price per Coin × Total Number of Coins in Circulation.

Market cap accurately reflects a cryptocurrency’s total value and relative market strength. For instance:

-

Bitcoin’s price might be tens of thousands of dollars per coin, but with limited supply, its market cap makes it the largest and most stable cryptocurrency.

-

A smaller coin might be priced at just $0.10 per unit, but with billions of coins circulating, it can still have a substantial market cap, reflecting its actual market value.

Therefore, when considering fractional Bitcoin versus altcoins, focus primarily on market cap and overall market strength, rather than simply the unit price. A cryptocurrency with a low unit price doesn’t necessarily offer better investment value if it has low adoption, limited utility, or weak fundamentals16.

Balancing Your Crypto Investment Strategy

Both fractional Bitcoin and whole altcoins can play valuable roles in your overall cryptocurrency portfolio:

-

Fractional Bitcoin ownership offers stability, legitimacy, and steady long-term potential.

-

Selective altcoin investments may offer potential for higher risk-reward opportunities but require careful research and active management.

For beginners, a balanced approach can be wise: start by building a strong base in fractional Bitcoin through regular, disciplined investments (such as dollar-cost averaging), and then carefully explore altcoins once you’ve gained experience and deeper market understanding.

By carefully weighing these considerations, you can make smart investment choices that align with your personal financial goals, risk tolerance, and long-term strategy.

Frequently Asked Questions (FAQs) About Buying Fractional Bitcoin

As you begin your fractional Bitcoin investment journey, it’s normal to have questions. This section clearly answers common beginner queries, ensuring you have all the information you need to start confidently.

What is the absolute minimum amount of Bitcoin I can buy on major exchanges?

On most cryptocurrency exchanges—like Coinbase, Binance, Kraken, and Gemini—the minimum purchase amount is extremely low, often as little as $1 to $2.

In terms of Bitcoin units, this translates into roughly 2,000 to 4,000 satoshis, depending on Bitcoin’s current price.

This low barrier to entry makes Bitcoin investing accessible to virtually anyone, allowing you to start with an amount you’re comfortable investing without substantial risk17.

Are the fees higher for smaller Bitcoin purchases?

When buying very small fractions of Bitcoin, fees may appear proportionally higher compared to larger purchases. This occurs because exchanges typically charge a minimum fixed fee or a small percentage-based fee per transaction.

For example, if the fee is a fixed $0.99 for purchases under $10, buying exactly $1 of Bitcoin will incur a relatively high fee (99%). However, if you purchase $50 worth, the same fee might be just around 2%.

To minimize fees, consider investing slightly larger amounts at less frequent intervals. Platforms like Coinbase Pro or Kraken also offer lower fee structures compared to standard platforms, helping you reduce costs as your investment grows18.

How many satoshis (sats) are in 0.01 BTC?

Bitcoin is divided into 100 million satoshis (sats). To calculate how many sats you own, simply multiply the Bitcoin amount by 100 million.

For example:

-

0.01 BTC × 100,000,000 sats per Bitcoin = 1,000,000 sats.

Knowing how many sats you hold can help you track your investment more precisely and understand the fractional nature of Bitcoin ownership clearly19.

Can I send a fraction of a Bitcoin to another wallet?

Absolutely, you can send fractional amounts of Bitcoin from one wallet to another. Bitcoin’s blockchain supports sending amounts as small as a few hundred satoshis.

However, remember to consider network fees when sending Bitcoin, as fees are typically calculated based on network congestion and transaction complexity, not the amount you’re sending.

If you’re sending extremely small fractions, the transaction fee might represent a large percentage of your total transfer. It’s advisable to send larger fractions to reduce proportional fee costs20.

Do I pay taxes on fractional Bitcoin purchases?

In many countries, including the U.S. and U.K., buying Bitcoin itself is not a taxable event. However, selling Bitcoin or exchanging it for another cryptocurrency typically triggers a taxable event (capital gains taxes).

Even fractional Bitcoin purchases, when sold later for profit, may generate a taxable obligation. It’s important to keep accurate records of your Bitcoin transactions and consult a tax professional in your jurisdiction to fully understand your reporting requirements.

Using tax software or consulting a qualified tax advisor will ensure compliance and prevent unexpected tax liabilities.

How do I know my fractional Bitcoin is secure?

When you buy fractional Bitcoin from a reputable exchange, your holdings are stored securely in custodial wallets provided by the exchange itself. Reputable platforms utilize advanced security measures such as two-factor authentication (2FA), encryption, and insurance against theft or loss.

However, for optimal security—particularly when holding significant amounts—consider transferring your Bitcoin to a private, non-custodial wallet (hardware wallets such as Ledger or Trezor). With a private wallet, you maintain sole control over your private keys, maximizing security.

Always use strong passwords, enable 2FA, and avoid sharing sensitive wallet information with others.

Can fractional Bitcoin become valuable enough to matter?

Absolutely. Even fractional Bitcoin holdings have the potential to grow significantly over time.

Bitcoin’s long-term growth potential means that even small investments made consistently can accumulate into a substantial asset. Historically, early fractional investments have grown significantly as Bitcoin’s price appreciated over years.

Thus, fractional Bitcoin investments are not only accessible but also potentially valuable long-term holdings that may substantially benefit your financial future.

With these clear answers, you can confidently address common concerns and questions about fractional Bitcoin ownership, allowing you to make informed investment decisions without confusion or uncertainty.

Your Bitcoin Journey Starts with a Single Satoshi

Starting your Bitcoin journey can feel intimidating at first, especially when you see headlines highlighting Bitcoin’s high price. But as you’ve now clearly seen, you don’t need thousands of dollars—or even hundreds—to begin investing in Bitcoin.

Fractional Bitcoin ownership means the door is open to everyone, regardless of how much money you have to invest initially.

Remember, Bitcoin was explicitly designed to be inclusive. Its smallest unit, the satoshi, ensures that anyone can invest, even with just a few dollars. A single satoshi today could mark the start of your successful journey in cryptocurrency.

By purchasing fractional Bitcoin:

-

You’re participating in a proven, dominant cryptocurrency.

-

You’re taking advantage of potential long-term appreciation.

-

You’re beginning a disciplined, strategic investment habit (especially using dollar-cost averaging).

-

You’re breaking the psychological barrier that Bitcoin investing is “only for the wealthy.”

Your first fractional Bitcoin purchase—no matter how small—is not insignificant. It’s the first critical step into a rapidly growing digital economy that could have profound long-term implications for your financial future.

The next step? Just start.

Whether it’s $10, $50, or $100, simply making that initial investment can motivate further learning, exploration, and financial growth. As you continue learning and investing responsibly, your confidence, knowledge, and Bitcoin holdings will steadily grow.

In cryptocurrency, a single satoshi isn’t just the smallest unit—it’s your gateway into a world of financial innovation, opportunity, and possibility. Your Bitcoin journey truly begins with just one satoshi.

Start today, invest regularly, and watch your small steps grow into significant achievements.

Disclaimer

This article is provided strictly for educational and informational purposes only. It should not be interpreted as financial, legal, or investment advice. Investing in cryptocurrencies, including Bitcoin, carries significant risk due to high market volatility, regulatory uncertainty, and potential for loss of investment.

Always conduct thorough research and consult with qualified financial professionals before making any investment decisions. The author and publisher accept no responsibility for any financial decisions, outcomes, or losses resulting from the information provided herein.